Understanding the difference between a long term investors vs a day traders is essential for anyone entering the Indian stock market, as both follow completely different routines, risk approaches, and decision-making frameworks.

Long Term Investors vs a Day Traders

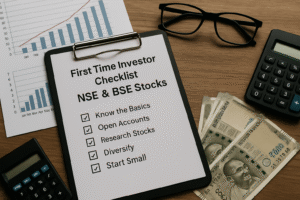

India’s stock market is a behemoth and has room for every kind of investor. But, on the spectrum of the Indian stock market, we have two poles with long term investors on one and day traders on the other. Both buy and sell stock on the same exchanges, NSE and BSE, and work with the same regulations. However, their styles are different when it comes to: capital allocation, time spent, risk profile, and mental frameworks and decisions made.

Anyone looking to invest in equities will have to understand these differences to some extent. To assist you, this is an exploration of a day in the life of a long term investors vs a day traders within the Indian ecosystem.

This is a comparison of the two extremes in this market. Neither side of the spectrum is better than the other. Rather, this is meant to show the realities of both sides, enabling one to decide and act according to one’s goals and risk tolerance.

Why Everyone Does as They Do

Before we get into the daily activities of each market participant, we must, for a moment, address the problem that governs the philosophy of both the styles. These governing philosophies, to some extent, determine their actions, emotional management, risk interpretation, and success measurement.

This type of investing looks at different key parts of a business. This includes fundamentals, compounding, and other business-related areas. Long-term investing is centered on understanding the belief of high-quality businesses increasing their profits over time. With this, the value of the shareholders increases.

Unlike long-term investing, day trading does not consider business fundamentals. It looks solely at the market. This includes things like real-time market behavior, price volatility, and other moving parts of the market. Precision and speed recognition over time is how day traders do what they do.

Based on their investing strategy, each person perceives the market differently, and this changes each day.

Daily Routine of A Long Term Investor

Morning: A Measured Start to the Trading Day

All investors start their day the same. It looks the same, and the same structured calmness follows. There is no big temptation to check minor price changes. The review of changes includes restructuring and changes to business-related macroeconomics and their updates. Overall, this is how long-term investors start their trading day.

In the morning, I start my day by looking at the headlines for important economic news. I look at the news that comes from economic news portals such as The Economic Times, Business Standard, and Mint. Also, I look at the performance of the Nifty 50 and Sensex as economic indicators and for general context on the indexes. Then I look for and review any updates related to corporate events like earnings releases, changes in regulations, and updates from the management about events. Finally, I look to see if there is news that has sufficient and significant impact on fundamentals over the long term.

As a long-term investor, I see the stock market as a long-term wealth creator, not a place for day-trading, and that my decisions should not be influenced by the day-trading volatility of the market, nor the crazy swings in the price of a stock that happen over the first few minutes of a trading session.

Midday: Studying Businesses and Ignoring Market Noise

I do not make any decisions and there is very little monitoring until mid day when I again do not monitor the market. I do not spend my work day around market decisions and do spend my time on studying the companies and their businesses, I review their quarterly financial results, and I look at the documents they share with investors, as well as the earnings conference calls that they conduct so that they can speak with a large group of investors all at the same time.

I also spend these midday hours to look at a few specific things. I like to look at the long-term revenue and growth in the key metrics of the businesses I am looking at. I look at the quality of the management and their policies on spending and investing capital. I look at the industry as a whole, and I look at the sizes of its competitors to see how they are doing in relation to the changes in the market and the key trends.

Because I am a long-term investor, I do not change my portfolio very often. I gladly accumulate shares of quality businesses and stable companies that I have done major research on. I look at the market over the long term, and I do make purchases of shares on a monthly basis in a very planned way. I also am not adverse to making any purchases during a major drop in stock prices to strategically make an accumulation of shares.

Midday market shifts do not change someone like them. Quality companies, even as markets move in waves, will grow and succeed. They have core principles that govern their strategy.

Evening: Reflection, Research and Learning

Long-term investors spend the end of the day learning. Education is a key pillar in their approach. They spend considerable time reading and analyzing patterns and gaining an understanding of market economics.

Their evenings consist of:

- economic report reviews

- analyzing performance over time

- studying the financial statements

- reading books on investing from Indian and other writers

- updating their personal investment journals

Long-term investing requires a significant amount of patience, discipline and an understanding of business in general. This is why evenings are used to improve the analytical mind, the structures used in thinking and the understanding of businesses that have the capability to sustain and grow their profit in the long run.

A Day in the Life of a Day Trader

Morning: Pressure and Speed, Pre-Market Preparation

A day trader will begin their day even earlier than the rest of the market. Their success depends, especially, on the pre-market period, as it will set the tone for the rest of the day.

A typical day trader’s morning routine includes:

- Checking SGX Nifty to assess the market’s mood

- Checking the performance of global markets (Dow Jones, Nasdaq, Nikkei)

- Watching the movement of the currency, crude oil, and bond yield

- Scouting event calendars for things like RBI policy meetings, releases of inflation data, and corporate results

- Creating a watchlist for high-volume stocks

Day traders rely on technical analysis and volume trading. They are able to predict even before the markets open where to enter and where to exit. They are structured, methodical, and data driven.

This out of market analysis has a huge impact on how well they do in the day.

Market Hours: Synchronized and Mentally Driven Execution

After the equity market opens, day traders enter a world of extreme volatility. They have to make movement at the speed of light.

When trading, day traders monitor:

- Candlestick patterns

- Volume surges and liquidity zones

- Support and resistance levels

- Technical indicators such as VWAP, RSI, MACD, Supertrend

- FII and DII activities

- Derivatives from Nifty and Bank Nifty

However, day traders do not focus on the long-term growth potential of a business; instead, they focus on the behaviour of the stock price and the discipline of entering and exiting at the right price.

This behaviour needs:

- Emotional neutrality

- Strict stop-loss discipline

- Risk-per-trade planning

- Constant re-working of the strategy

If they lose their focus for a few minutes, their funds can vanish. That is why day traders need to be strong psychologically.

Evening: Review and Prepare for the Next Day

Once the day trading market closes, day traders start their next “shift,” looking over the trades they made and the decisions they took.

Good and disciplined traders focus on:

- Reviewing their trades

- Pinpointing problems

- Tweaking their strategy

- Keeping a trading journal

- Looking for new opportunities

- Examining volatility zones

Traders work all day, sometimes pulling all-nighters to finalize a day’s analysis. In contrast, long-term investors simply review spreadsheets or news summaries.

Comparative Analysis: Long-Term Investor vs Day Trader

Decision-Making Framework

Long-term investors think in terms of years, making infrequent decisions based on business fundamentals.

Day traders make decisions within seconds or minutes.

Time Commitment

- Long-term investors: 30 minutes to 1 hour per day

- Day traders: 5 to 8 hours of intense activity

Risk Exposure

- Long-term investing: measured risk, less volatility impact

- Day trading: extremely high volatility and psychological pressure

Stress Levels

- Long-term investing: low stress

- Day trading: high stress and decision fatigue

Which Path Is Best for You?

The choice depends on:

- Risk tolerance

- Time availability

- Emotional control

- Goals

- Market knowledge

- Speed of working

If stability and compounding is preferred, long-term investing is suitable.

If one has advanced skills and can handle volatility, day trading may suit them.

Sooclix’s Financial Perspective

At Sooclix Finance, we think that for many Indian investors, long-term investing is the best path. Day trading can be profitable but requires specialized skills, practice and strict risk control.

Our advice to new investors: begin investing long-term, build a diversified portfolio and compound wealth.

Conclusion

Long-term investing and day trading involve different approaches and lifestyles. Understanding long-term investors vs day traders helps Indian investors select the right path according to temperament and long-term vision.