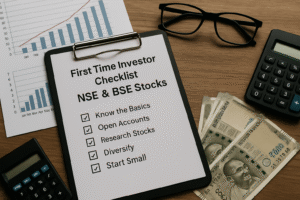

Start Investing with ₹1000 – Stock Market for Small Budgets

Introducing: Small Money, Big Dreams

Think a lakhs to tap on stock market? Think again.

All it takes is ₹1000 to start your way towards financial freedom. The stock market is no longer just for elite investors — it’s accessible to anyone with a grasp of how to invest wisely.

In this post, we’ll show you how to begin investing even if you have a small budget, accumulate wealth over time and let your money work for you — no matter whether you’re in college or just starting out.

Why ₹1000 is Enough to get Started with Investing

For most beginners, this is another thing you will likely believe: That if you’re not investing significant amounts of money it’s not worth it — but that’s a myth.

Here’s why ₹1000 is an ideal entry point:

- Learning Without Fear: You aren’t putting large amounts of money on the line here, so what failures provide you with are education not losses.

- Fractional Investing: Apps such as Groww, Zerodha and Upstox allow you to buy shares with just ₹10–₹50.

- Power of Compounding: Investment is in small amounts, but regular and exponential in nature.

- Habit Building: Invest ₹1000 per month and create financial discipline that lasts you a lifetime.

Step by Step Guide: How to Begin Investing with ₹1000

Step 1: Download a Reputable Stock Market App

The best platforms for beginners in India are these:

- Groww

- Upstox

- Zerodha (Kite)

- Angel One

It takes just 5 minutes to open your Demat + Trading account — free or less than ₹300.

Step 2: Know Where to Put Your Money

A fund of ₹1000 would be to educate and diversify. You can invest in:

- Exchange Traded Funds (ETFs): low risk, diverse party items

- Blue chip Stocks: They are super stable and of companies like HDFC, Infosys, TCS

- Mutual Funds (SIP ): ₹500 / month SIP, starting amount

- Index Funds: replicate the performance of Nifty 50 or Sensex

Step 3: Aim to Be Steady, Not Quick — Don’t Rush for Profits

It doesn’t take long to be a stock market success.

Begin with ₹1000 monthly investment (and not just a one-time investment). That’s how you build wealth.

Example:

If you contribute ₹1,000 monthly and continue for 5 years with an average return of 12% annually, that extra ₹60,000 expense grows to about ₹82,000.

That’s the magic of compounding. 💫

Tips for Small-Budget Investors

- Do Your Own Research: Review the company’s financials, revenue growth and P/E ratio.

- Begin with SIPs: If you are investing, automate and be consistent.

- Reinvest Profits: Small returns should never be withdrawn but rather reinvested in order to compound.

- Be Patient: Don’t get caught up in the pursuit of daily profits. Think long-term (minimum 3–5 years).

- Keep Studying: Subscribe finance blogs such as Sooclix Finance for insights from the gurus.

How to Track Your Progress

Use free tools and apps like:

- Tickertape for company analysis

- Moneycontrol Portfolio for performance tracking

- TradingView for charting and viewing market trends

Monitor your ROI every three months — not daily.

The answer is repetition, not fixation.

Example Portfolio with ₹1000

Here’s a sample beginner’s portfolio:

| Investment Type | Allocation | Amount (₹) |

|---|---|---|

| Blue-chip stock (e.g. HDFC Bank) | 40% | 400 |

| ETF or Index Fund | 30% | 300 |

| SIP in Mutual Fund | 20% | 200 |

| Cash reserve | 10% | 100 |

This blend balances diversification + stability, even for small budgets.

The Sooclix Way to Be Wise with Your Money

At Sooclix Finance, we understand the value of a Rupee.

Our objective is to provide young investors with the right tools (digital), habits (systemized) and information/data-driven insights (real-value) to leverage a small budget.

Whether you want to learn stock trading, money managing or financial planning, we have everything covered — step by way of module.

Get onboard Sooclix Finance — Race to riches today.

Conclusion: Small Is Beautiful, But Big Will Be Irrigable

It’s not about how much you invest in the stock market; it’s about how early and regularly you do so.

So why wait for the “right time” or “big money”?

Begin with your ₹1000 today and let it compound for the rest.

Keep in mind, all successful investors started out with baby steps — yours starts here and now.