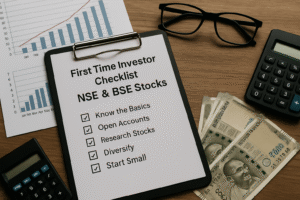

Turn Your First $1,000 in the Market into Smart Growth

Starting Small, Thinking Big

If you’ve already gotten disciplined enough to save your first $1000, good for you — that already puts you ahead of far too many people who talk a big game but never actually do anything.

But now the questions start: What do you do with that money? Where should it go? And how are you able to grow it without losing all of it?

The good news? You needn’t be a financial wizard to start your first $1000 working for you.

You just need a plan, some patience and the right mindset.

In this guide, we’ll cover three fast-and-effective investment moves for your first $1000 in the market — and just how much return you might be able to count on from each.

Path 1: Index Funds and ETFs — The Beginner’s Highway

Why It’s Great for Beginners

If you’re new to the Stock Market , index funds and exchange-traded funds are your friends. They take your cash and automatically invest it in a basket of companies — such as the S&P 500 in the U.S. or the Nifty 50 in India, for example — thereby giving you instant diversification and reducing your overall risk.

That makes them perfect for someone beginning with Your First $1000 in the Market.

Example:

Put your $1000 in a low-cost index ETF (a Nifty 50 ETF or S&P 500 ETF).

Average annual return: 8–12% (in the long run)

Minimum maintenance: invest and forget

What to Expect:

It won’t make you wealthy overnight, but over time and with patience, your money will grow while you gain experience watching the market move.

Consider this your investing classroom — you’re learning valuable lessons while your money itself is making more money. Wait a few years and the compound surprise will please you.

Option 2: Blue-Chip Dividend Stocks – The Slow and Steady Route

Why It’s Great

Financially sound and less risky, blue-chip companies (HDFC Bank, Infosys in India; Apple or Microsoft) form the cream of the stock market. These are well-known names that have reliable increases and excellent track records.

They pay dividends, too — you earn passive income by simply holding them.

Example Portfolio

| Type of Stock | Investment | Anticipated Annual Return |

|---|---|---|

| Blue-chip stocks | $700 | 10–12% |

| Cash-generating stocks | $300 | 3–5% (dividend yield) |

What to Expect

You’re not going to make a bundle in the short run but over time you will have consistent, dependable growth — and receive small dividend checks every few months.

It may not sound thrilling, but it is best suited for those of us who want a lifetime of wealth without sacrificing our nights and weekends. And, of course, over time those dividends that are reinvested can compound your returns.

Way 3: Neutral Middle – Safety Learning

Why It’s Great

And if you’re uncertain where to begin, balance is everything.

When you break up your $1000 into a few different types of investments — individual stocks and ETFs as well as some savings — you automatically reduce risk and expedite the learning curve.

Example Split

| Investment Type | Allocation | Amount ($) |

|---|---|---|

| Index Fund (ETF) | 50% | 500 |

| Blue-chip Stock | 30% | 300 |

| Emergency Fund / Cash | 20% | 200 |

What to Expect

This approach enables you to learn by doing — and protects some money in the meantime.

You get to see the market in action without the risk of losing it all. And when markets fall, your cash balance provides a cushion of safety and the opportunity to buy additional shares at lower prices.

This builds emotional discipline — one of the most valuable skills for an investor.

What First-Time Investors Need to Know

Ups and Downs Are Normal

Markets move up and down every single day — that’s not a concern, it’s how the system works.

When red flag, don’t freak out. The real danger isn’t the market downturns themselves but our emotional reactions to them.

Patience Pays

Compounding is for the long term, not a quick fix. The longer you keep the money, the more of a return you get.

In the immortal words of Warren Buffett: “The stock market is there to transfer money from the impatient to the patient.”

Stay Educated

Continue to read blogs about finance, watch videos on investing, and follow sites like Sooclix Finance for actionable advice.

There are compounding benefits to knowing things, he explains: “You learn stuff — knowledge is power.” And as with wealth, knowledge compounds.

Reinvest Your Earnings

Dividends and small profits may seem minuscule at first — but if you reinvest them, your returns multiply. That’s how compounding truly shines.

Think Long Term

Your first $1000 in the market is not about “getting rich.” It’s about building a foundation.

When you learn discipline at small amounts like $10, scaling up to $10,000 (or later higher) is easy.

Bonus Path: Invest in Yourself

Before you dive into the stock market, it might help to allocate a portion of your $1,000 to learn about investing.

Purchase one solid investing course or book — such as The Intelligent Investor or One Up on Wall Street.

Even $50 invested in the right knowledge can help you make better decisions and prevent big losses.

Keep in mind — financial education is the greatest ROI investment you will ever make.

The Sooclix Finance Perspective

At Sooclix Finance, not the size of your start that matters.

Your first $1000 isn’t just an investment; it’s a deposit on your financial independence.

We teach young investors and beginners how to:

- Analyze markets with confidence

- Manage risks smartly

- Grow rich in discipline and clarity

👉 Start your journey with Sooclix Finance — where finance meets clarity.

Conclusion: Today, Not Someday

Nobody has ever picked the perfect moment to invest — all anyone can do is start investing.

That is, of course, how every great investor starts out and it’s not always with lots of money; it’s often little by little over time.

Here are a few thoughts to mull over when you consider what your first $1000 might eventually be worth for you. (“Might” obviously depends on savings consistency and time.)

Your $1,000 may feel meaningless or negligible now, but with patience and follow-through on saving more responsibly than many people do in our culture of instant gratification and credit-addled thinking, that money could realistically blossom into a huge chunk of change — at least $10k probably; quite possibly more:

It is just a matter of deciding, being disciplined and remaining consistent.

So don’t let it lay there sleeping — put it to work, and let compounding do its beautiful thing.